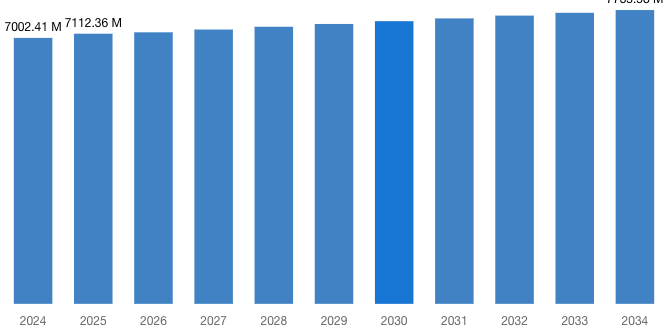

[Latest] Global Sustainable Supply Chain Finance Market Size/Share Worth USD 7,735.58 Million by 2034 at a 8.15% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

[220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of Global Sustainable Supply Chain Finance Market size & share revenue was valued at approximately USD 7,002.41 Million in 2024 and is expected to reach USD 7,112.36 Million in 2025 and is expected to reach around USD 7,735.58 Million by 2034, at a CAGR of 8.15% between 2025 and 2034. The key market players listed in the report with their sales, revenues and strategies are Industrial and Commercial Bank of China, Citigroup, ExportImport Bank of China, Deutsche Bank, ING, Bank of China, China Construction Bank, BNP Paribas, Ant Group, Wells Fargo, JPMorgan Chase, HSBC, Bank of America, Agricultural Bank of China, Standard Chartered, and others.

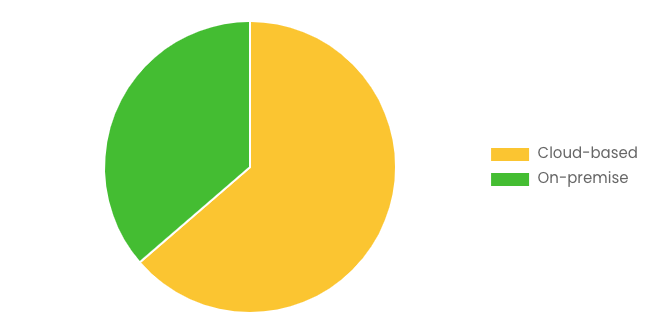

/EIN News/ -- Austin, TX, USA, April 15, 2025 (GLOBE NEWSWIRE) -- Custom Market Insights has published a new research report titled “Sustainable Supply Chain Finance Market Size, Trends and Insights By Type of Financing (Invoice Financing, Purchase Order Financing, Inventory Financing, Warehouse Receipt Financing, Freight Financing, Asset-Backed Lending), By Industry Vertical (Manufacturing, Retail, Transportation, Healthcare, Technology, Energy, Agriculture), By Company Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Deployment Model (Cloud-based, On-premise), By Integration (Enterprise Resource Planning (ERP) Systems Integration, Supply Chain Management (SCM) Systems Integration, Transportation Management Systems (TMS) Integration), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034” in its research database.

“According to the latest research study, the demand of the global Sustainable Supply Chain Finance Market size & share was valued at approximately USD 7,002.41 Million in 2024 and is expected to reach USD 7,112.36 Million in 2025 and is expected to reach a value of around USD 7,735.58 million by 2034, at a compound annual growth rate (CAGR) of about 8.15% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the Global Sustainable Supply Chain Finance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=68456

Sustainable Supply Chain Finance Market Growth Factors and Dynamics

Surge in Investment Fuels Market Growth in Supply Chain Finance:

The supply chain finance market is anticipated to experience development in the future due to the increase in investment in small and medium-sized enterprises (SMEs) for supply chain finance. Small and medium-sized enterprises (SMEs) are organizations that have a specific number of employees, assets, or revenues that are less than a specified size.

Supply chain finance enables small and medium-sized enterprises (SMEs) to access a greater volume of bank credit based on the strength and volume of their trade transactions. These credits are accessible at significantly lower interest rates, which helps SMEs overcome working capital challenges and improve their overall financial health.

This ensures an uninterrupted flow of materials and services from their smallest suppliers to the timely delivery of finished goods to their clients. For example, the U.S. Small Business Administration (SBA), a federal agency based in the United States, reported that small businesses accounted for 99.9% of all businesses in the United States in November 2023, with a total of 33.3 million businesses.

Furthermore, a net increase of 447,519 businesses was achieved because of the 1.4 million new establishments that were launched between March 2021 and March 2022. Consequently, the supply chain finance market experiences development as a result of the increase in investment in SMEs for supply chain finance.

Request a Customized Copy of the Sustainable Supply Chain Finance Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=68456

The expansion of the supply chain finance market is being driven by the emergence of new fintech solutions.

We anticipate that the emergence of FinTech solutions will lead to future development in the supply chain finance market. FinTech solutions are products, services, or applications that are technology-driven and innovative to offer modern and efficient solutions for various financial activities.

By optimizing and expediting financial transactions within the supply chain, supply chain finance supports fintech solutions, thereby improving overall efficiency, transparency, and agility. In November 2023, the International Trade Administration, a US-based government agency, reported that the UK’s FinTech market had over 1,600 companies.

This figure is anticipated to triple by 2030. This industry generates over 76,000 jobs and an estimated $13.4 billion (£11 billion) for the UK economy. Consequently, the supply chain finance market is experiencing growth as a result of the increasing prevalence of FinTech solutions.

Technological innovations are transforming the supply chain finance market.

Technological innovation is a significant trend that is gaining traction in the supply chain finance market. To fortify and preserve their market position, major organizations in the supply chain finance sector are emphasizing product innovation.

For example, in March 2022, IBSFINtech, a treasury tech company based in India that offers end-to-end digitization and automation solutions, introduced VNDZY (Vendor Management Made Easy), a SaaS platform that is AI-based. This platform provides a mutually advantageous platform for all parties and addresses all supply chain ecosystem concerns by offering a connected ecosystem for corporations, suppliers, and financial institutions.

Furthermore, the technology assists suppliers by reducing the time it takes for IT to process payments, thereby promoting financial discipline.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 7,112.36 Million |

| Projected Market Size in 2034 | USD 7,735.58 Million |

| Market Size in 2024 | USD 7,002.41 Million |

| CAGR Growth Rate | 8.15% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Type of Financing, Industry Vertical, Company Size, Deployment Model, Integration and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Sustainable Supply Chain Finance report is available upon request; please contact us for more information.)

Our free sample report consists of the following:

- Introduction, overview, and in-depth industry analysis are all included in the 2024 updated report.

- The package includes the COVID-19 Pandemic Outbreak Impact Analysis.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2025

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Sustainable Supply Chain Finance report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Sustainable Supply Chain Finance Market Report @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Sustainable Supply Chain Finance Market Recent Developments and News

- KredX, a supply chain finance platform, was granted permission by the Reserve Bank of India (RBI) to develop a Trade Receivables Discounting System (TReDS) platform in January 2025. KredX is authorized to auction trade receivables with this authorization, which simplifies financing for micro, small, and medium-sized enterprises (MSMEs). The action is expected to enhance liquidity and promote the expansion of small businesses by providing access to regulated, effective financial solutions.

- In January 2025, NEC Thailand and AIRA Factoring launched a digital supply chain financing platform with the objective of assisting small and medium-sized enterprises (SMEs) in Thailand. The platform will leverage NEC's digital capabilities and "TASConnect" to enhance supply chain finance programs, improve cash flow, and increase credit disbursement. This partnership is consistent with Thailand’s 4.0 strategy, which emphasizes sustainable economic growth and innovation.

- November 2024: The Reserve Bank of India (RBI) has directed non-banking financial companies (NBFCs) to provide exhaustive information regarding the financing of their supply chains. The Reserve Bank of India is implementing this measure as part of its endeavors to enhance transparency and monitor risks within the financial ecosystem. One of the primary objectives is to enhance financial stability and regulatory monitoring by comprehending the scope and composition of their supply chain finance activities.

Request a Customized Copy of the Sustainable Supply Chain Finance Market Report @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Key questions answered in this report:

- What is the size of the sustainable supply chain finance market, and what is its expected growth rate?

- What are the primary driving factors that push the sustainable supply chain finance market forward?

- What are the sustainable supply chain finance industry's top companies?

- What are the different categories that the Sustainable Supply Chain Finance Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Sustainable Supply Chain Finance market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2025−2034

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Sustainable Supply Chain Finance Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Sustainable Supply Chain Finance Market Regional Analysis

The Asia-Pacific region accounted for 43.5% of the sustainable supply chain finance market share in 2024. The report indicates that Asia-Pacific possessed the largest market share due to the region’s diverse range of industries, which included electronics, textiles, automotive, and pharmaceuticals.

This diversity is resulting in intricate supply chain ecosystems that necessitate sophisticated financing solutions. In addition, the Asia Pacific region is home to a substantial number of financial institutions and investors. The availability of capital is facilitating the development and expansion of supply chain finance programs.

Additionally, the market is experiencing growth as a result of the pervasive adoption of advanced technologies, including real-time data processing platforms. These advancements enable the processing of loans at a quicker and more efficient pace, thereby increasing the availability of financing for a diverse array of suppliers.

In Japan, AEON Bank, a subsidiary of AEON Financial Service, introduced a novel supply chain finance service known as “Invoice Finance” in 2024. By utilizing real-time transaction data between AEON Group companies and their suppliers, this service offers financing to suppliers. The system is constructed on the iQuattro® platform by NTT DATA Corporation, which facilitates the rapid and efficient processing of loans without collateral.

The United States accounted for 85% of the total market share in North America. The supply chain financing (SCF) sector in the United States is primarily driven by the increased adoption of digital payment systems and the development of e-commerce.

According to data from the United States government, SCF solutions are essential for over 30 million SMEs that operate in the country in order to improve cash flow and shorten working capital cycles. According to a paper published by Harvard University, the United States supply chain is a critical sector for the country, with 44 million employees and 37% of all job opportunities.

The integration of fintech technologies and the robust banking system in the United States has resulted in over 50% of U.S. enterprises utilizing supply chain financing in some capacity.

Request a Customized Copy of the Sustainable Supply Chain Finance Market Report @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Sustainable Supply Chain Finance Market Size, Trends and Insights By Type of Financing (Invoice Financing, Purchase Order Financing, Inventory Financing, Warehouse Receipt Financing, Freight Financing, Asset-Backed Lending), By Industry Vertical (Manufacturing, Retail, Transportation, Healthcare, Technology, Energy, Agriculture), By Company Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Deployment Model (Cloud-based, On-premise), By Integration (Enterprise Resource Planning (ERP) Systems Integration, Supply Chain Management (SCM) Systems Integration, Transportation Management Systems (TMS) Integration), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034” Report at https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

List of the prominent players in the Sustainable Supply Chain Finance Market:

- Industrial and Commercial Bank of China

- Citigroup

- ExportImport Bank of China

- Deutsche Bank

- ING

- Bank of China

- China Construction Bank

- BNP Paribas

- Ant Group

- Wells Fargo

- JPMorgan Chase

- HSBC

- Bank of America

- Agricultural Bank of China

- Standard Chartered

- Others

Click Here to Access a Free Sample Report of the Global Sustainable Supply Chain Finance Market @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- We offer free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- The author has created a personalized market brief.

Browse More Related Reports:

Letter Of Credit Confirmation Market: Letter Of Credit Confirmation Market Size, Trends and Insights By Type (Issuing Bank Confirmation, Accredited Independent Confirmation, Confirming Bank Confirmation), By Application (Import, Export, Domestic Transactions), By Size of Letter (Small Letters of Credit, Medium Letters of Credit, Large Letters of Credit), By Tenor (Short-Term Letters of Credit, Medium-Term Letters of Credit, Long-Term Letters of Credit), By Confirmation Fee Structure (Fixed Fee, Percentage Fee, Tiered Pricing), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034

EMV Card Market: EMV Card Market Size, Trends and Insights By Card Type (Credit Cards, Debit Cards), By Application (Retail, Banking, Financial Services, and Insurance (BFSI), Hospitality, Healthcare, Transportation, Others (e.g., government, education)), By End-User (Consumers, Merchants), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

ATM Security Market: ATM Security Market Size, Trends and Insights By ATM Type (Onsite ATM, Offsite ATM), By Application (Fraud Detection, Security Management, Anti-Skimming, Others), By End User (Banks and Financial Institutions, Independent ATM Operators), By Solution (Deployment, Managed Service) and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Doorstep Banking Market: Doorstep Banking Market Size, Trends and Insights By Component (Software, Services), By Deployment Model (On Premise, Cloud Based), By Services (Financial Services, Non-Financial Services, Others), By Application (Personal Banking, Business Banking), By End-User (Banks, Financial Institutions, Credit Unions, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

B2B Payments Market: B2B Payments Market Size, Trends and Insights By Payment Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Large Enterprises, Small and Medium Sized Enterprises), By Payment Mode (Traditional, Digital), By Industry Vertical (BFSI, Manufacturing, Metals & Mining, IT & Telecom, Energy & Utilities, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

NBFC Market: NBFC Market Size, Trends and Insights By Type (NBFCs Accepting Public Deposit (NBFCs-D), NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND)), By Service Type (Lending Services, Investment Services, Insurance Services, Leasing Services, Others), By Deployment Mode (Online Deployment, Branch-Based Deployment, Hybrid Deployment, Agent-Based Deployment, Others), By Application (Consumer, SME & Commercial Lending, Wealth Management, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Banking as a Service Market: Banking as a Service Market Size, Trends and Insights By Component (Platform, Services), By Product Type (API-Based Banking-as-a-Service, Cloud-Based Banking-as-a-Service), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End Users (Banks, NBFC, Government, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe B2B Payments Market: Europe B2B Payments Market Size, Trends and Insights By Payment Methods (Traditional Payment Methods, Digital Payment Methods), By Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End User (Manufacturing, Retail and E-commerce, Healthcare, IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Energy and Utilities, Transportation and Logistics, Travel and Hospitality, Others), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

We have segmented the Sustainable Supply Chain Finance Market as follows:

By Type of Financing

- Invoice Financing

- Purchase Order Financing

- Inventory Financing

- Warehouse Receipt Financing

- Freight Financing

- Asset-Backed Lending

By Industry Vertical

- Manufacturing

- Retail

- Transportation

- Healthcare

- Technology

- Energy

- Agriculture

By Company Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Model

- Cloud-based

- On-premise

By Integration

- Enterprise Resource Planning (ERP) Systems Integration

- Supply Chain Management (SCM) Systems Integration

- Transportation Management Systems (TMS) Integration

Click Here to Get a Free Sample Report of the Global Sustainable Supply Chain Finance Market @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Sustainable Supply Chain Finance Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Sustainable Supply Chain Finance Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Sustainable Supply Chain Finance Market? What Was the Capacity, Production Value, Cost and PROFIT of the Sustainable Supply Chain Finance Market?

- What Is the Current Market Status of the Sustainable Supply Chain Finance Industry? What's Market Competition in This Industry, Both Company and Country Wise? What's Market Analysis of Sustainable Supply Chain Finance Market by Considering Applications and Types?

- What Are Projections of the Global Sustainable Supply Chain Finance Industry Considering Capacity, Production, and Production Value? What Will Be the estimate of Cost and Profit? What Will Be Market Share, Supply and Consumption? How will imports and exports be affected?

- What Is Sustainable Supply Chain Finance Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact on the Sustainable Supply Chain Finance Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What are the market dynamics of the Sustainable Supply Chain Finance Market? What Are Challenges and Opportunities?

- What should be entry strategies, countermeasures to economic impact, and marketing channels for the sustainable supply chain finance industry?

Click Here to Access a Free Sample Report of the Global Sustainable Supply Chain Finance Market @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Reasons to Purchase Sustainable Supply Chain Finance Market Report

- Sustainable Supply Chain Finance Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Sustainable Supply Chain Finance Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Sustainable Supply Chain Finance Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- We provide extensive company profiles that include company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry's current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- The sustainable supply chain finance market includes in-depth market analysis from various perspectives through Porter's five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Sustainable Supply Chain Finance market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players drive market growth.

Buy this Premium Sustainable Supply Chain Finance Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Sustainable Supply Chain Finance market analysis.

- The report covers the competitive environment of current and potential participants in the Sustainable Supply Chain Finance market, as well as those companies' strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- We have provided actual market sizes and forecasts for each segment mentioned above.

Who should buy this report?

- Participants and stakeholders in the worldwide sustainable supply chain finance market should find this report useful. The research will be useful to all market participants in the sustainable supply chain finance industry.

- Managers in the Sustainable Supply Chain Finance sector are interested in publishing up-to-date and projected data about the worldwide Sustainable Supply Chain Finance market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in sustainable supply chain finance products' market trends.

- Analysts, researchers, educators, strategy managers, and government organizations seek market insights to develop plans.

Request a Customized Copy of the Sustainable Supply Chain Finance Market Report @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work toward achieving sustainable growth in their respective domains.

CMI offers a comprehensive solution from data collection to investment advice. Our company's expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts apply client insights on aspects such as strategies for future estimation falls, forecasting or opportunities to grow, and consumer surveys.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://businessresearchindustry.com

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Sustainable Supply Chain Finance Research Report | Fast Delivery Available [200+ Pages] @ https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release